Incentives Are Available for Those Investing in Dominica

AVAILABLE INCENTIVES PACKAGE

The government of Dominica offers fiscal incentives to qualifying enterprises to support their establishment, expansion, and continued operation within various sectors to include, but not limited to the

UP TO 100% TAX HOLIDAY 100% REPATRIATION OF PROFIT MAXIMUM OF 15/20 YEARS TAX HOLIDAY NO CAPITAL GAINS TAX POLICY REGIME

- Approved manufacturers policy to support the acquisition of equipment, machinery, packaging, and labeling materials used in production

- The Income Tax Act, Chapter 67.01 and the Hotels Aid Act, Chapter 85:04, allow for the granting of incentives for hotel and resort development.

- The Fiscal Incentives Act, Chapter 84:51 and the Fiscal Incentives (Amendment) Act No. 3 of 2019 makes provision for support to manufacturers, agro-processors, ICT enterprises and other service providers.

- Approved development policy to support a tourism real estate development or other development with an investment of more than EC$3 million and approved by Cabinet

- The Value Added Tax Amendment Act No. 4 of 2006 grants approved entities VAT exemption on capital imports up to the commencement of taxable activities.

THE PROCESS OF APPLYING FOR INCENTIVES

Invest Dominica Authority assists investors in applying for Fiscal Incentives. Applications are submitted to the IDA, which makes recommendations to Government on the level and types of incentives that should be granted. This allows for a high level of flexibility based on the needs of each project.

The application process is non-discriminatory. Any enterprise – small, large, domestic, or foreign – can apply for incentives.

- Application form along with relevant supporting documents are submitted to Invest Dominica Authority;

- Application is reviewed and processed by Invest Dominica Authority;

- Recommendation on the eligibility and/or quantum of incentives to be granted is submitted to Cabinet for consideration;

- Decision is submitted by Cabinet to the Invest Dominica Authority;

- The Invest Dominica Authority informs the client of Cabinet’s decision.

BOILING LAKE

FORT SHIRLEY NATIONAL PARK

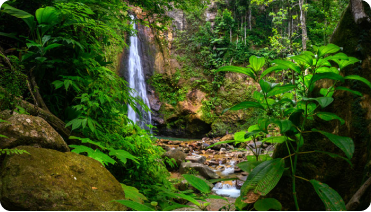

MILTON FALLS

BOILING LAKE

FORT SHIRLEY NATIONAL PARK